Simply Wall St: Stock Analysis app

free Simply Wall St: Stock Analysis app

download Simply Wall St: Stock Analysis app

Simply Wall St: Stock Analysis apk

free Simply Wall St: Stock Analysis apk

download Simply Wall St: Stock Analysis apk

Simply Wall St: Stock Analysis

4.7

100K+

About This app

Research companies, not stocks.

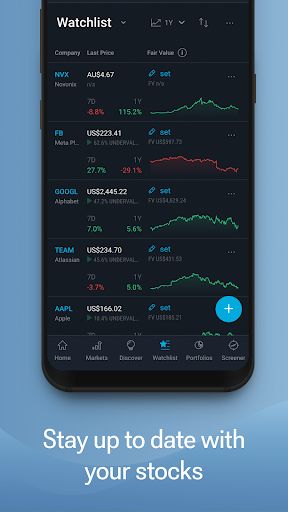

Easy to use Simply Wall St reports put expert level analysis and insights in the hands of any investor. Know when insiders are buying or selling, dig into earnings announcements and manage multiple watchlists and stock portfolios.

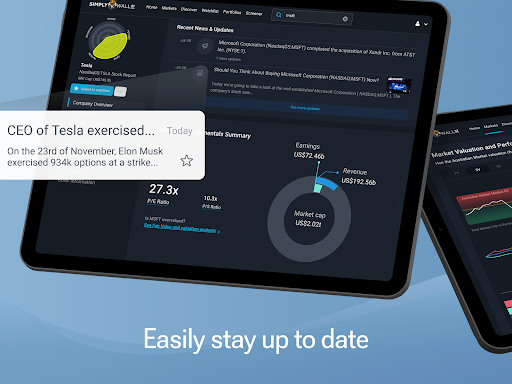

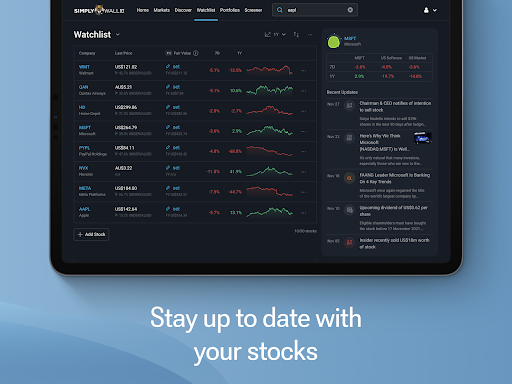

Stay Up To Date With Key Stock Market NewsStay up to date with important events and news on your stocks like earnings, insider trades and dividends. Your dashboard is the hub for all the latest developments on your stocks.

You can also be notified of important developments. Data and analysis is updated regularly, identifying opportunities as fast as possible.

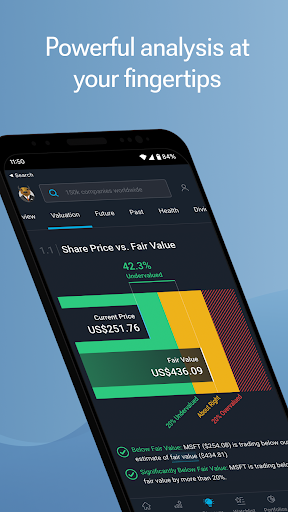

Deep Stock AnalysisOur unique Snowflake Analysis enables you to use sophisticated stock analysis techniques to quickly find new investment opportunities, while also being able to dive into the details.

Understand how a company has grown in the past, what its prospects are for the future, or if its dividend is sustainable.

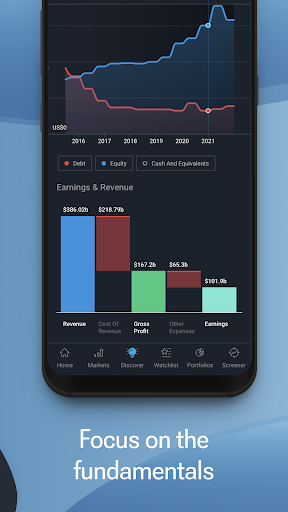

Investing is about companies, not tickers. We help you focus on what matters with institutional quality data and best in class infographics.

We focus on 5 areas of fundamental analysis: Value, Past Growth, Future Growth, Dividend and Health. You can also find stocks using this analysis, or use our pre-built investing ideas and screeners.

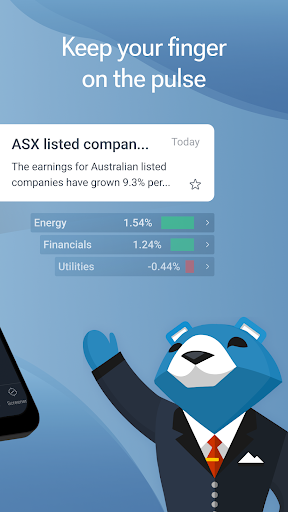

Market Analysis & NewsStay up to date with the latest market trends to inform your research, find opportunities and build a strategy.

Our market analysis allows you to identify trends, value industries and spot what others have been overlooking.

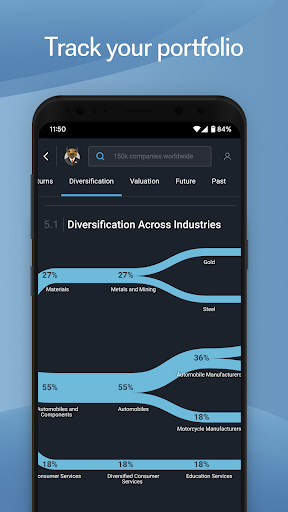

Build A Robust Stock PortfolioWe analyse your portfolio and visualise it so you have a full understanding of the where you are invested, and your strengths and weaknesses.

Track your portfolio and stay up to date with the latest news and analysis.

Find New Investing Ideas With Our Detailed Stock ScreenerOur powerful discover collections and stock screener allow you to find new stocks to research and invest in, no matter your criteria.

Our stock screener is powered by our snowflake analysis so you can find exactly the type of company you want, be it growth, value, dividend or something in between.

How does the stock analysis work?The analysis uses institutional quality data from Standard and Poor’s Capital IQ and performs 30 checks across 5 different areas.

Over 1,000 data points are used to analyse each company and are updated every 6 hours.

Each company also has a Snowflake graph to give you a quick snapshot of company’s investment profile.

► ValueDiscounted Cash Flow calculation (DCF), PE ratio, PB ratio, PEG Ratio.

► Future PerformanceAnalyst estimates of Future Earnings Growth, Revenue, Cash flow, Earnings and Return on Equity.

► Past PerformanceEPS growth, Return on Equity (ROE), Return on Capital Employed (ROCE) and Return on Assets (ROA) over the past 5 financial years.

► Financial HealthAnalysis of a company's Balance Sheet, in particular the amount of debt held by the company. (Note: we use a different financial health analysis for Banks and Financial Institutions.)

► Income (dividends)Dividend payment in terms of its absolute level and against other dividend payers. In addition, the app analyses the volatility and sustainability of the dividend.

All of this analysis is connected to the stock screener, where you can search for companies meeting or exceeding any of the checks, and filter by market, industry and more.

Stock Markets Covered

United States(NYSE, NASDAQ & OTC)

Canada (TSX, TSXV & CSE)

Australia (ASX)

New Zealand (NZX)

Hong Kong (HKG)

Singapore (SGX)

India (NSE & BSE)

Austria (VIE)

Belgium (EBR)

Switzerland (SWX & BRSE)

Germany (FRA, ETR, BST & MUN)

Denmark (CPH)

Spain (BME)

Finland (HLSE)

France (EPA)

Greece (ATSE)

Hungary (BUSE)

Ireland (ISE)

Italy (BIT)

Luxembourg (BDL)

Netherlands (AMS)

Norway (OB)

Poland (WSE)

Portugal (ELI)

Russia (MCX)

Sweden (STO)

Show More

Screenshots

Comment

Similar Apps

Top Downloads

Copy [email protected]. All Rights Reserved

Google Play™ is a Trademark of Google Inc.

ApkYes is not affiliated with Google, Android OEMs or Android application developers in any way.