Curve | Supercharge your money app

free Curve | Supercharge your money app

download Curve | Supercharge your money app

Curve | Supercharge your money apk

free Curve | Supercharge your money apk

download Curve | Supercharge your money apk

Curve | Supercharge your money

2.6

1M+

About This app

What is Curve?

Curve is not a bank. It’s a single card connecting all your debit cards and credit cards in one.

Supercharge your money with Curve

Pay from any account with just one card

Remember just one PIN

Go Back in Time® to switch payments from one card to another, up to 30 days after you’ve paid

Earn cashback on top of any rewards you get with another card

Eliminate foreign exchange fees from any card. Yes, even your credit cards.

Split any payment from the past year into instalments with Curve Flex

See what you’re spending across all your cards at once

Get live notifications

Manage your business expenses more seamlessly, with receipts and categories of spend

Make any card work with Apple Pay/Google Pay

All your cards in one

Add any Mastercard, Visa or Discover card to Curve. Pay with your physical Curve card, or add Curve to your phone or smartwatch for cardless payments on the go. If your bank or credit card doesn’t support Apple Pay or Google Pay – just add it to Curve and leave your wallet behind.

American Express not yet supported

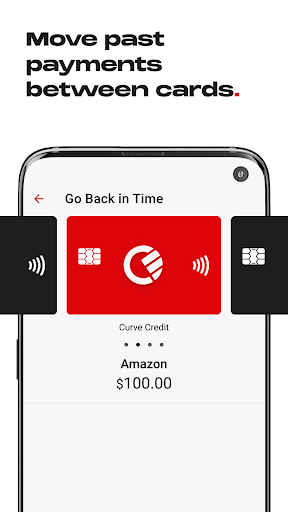

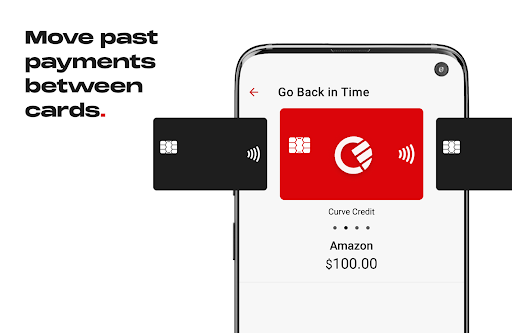

Go Back in Time®

The power to switch payments from one card to another. A tiny time machine in your pocket. Whether you’ve accidentally paid with the wrong card or need to reshuffle your finances, you can always press rewind with Curve.

Curve Flex

The power to split almost any payment from the past year into instalments*. Free up money instantly and rework your budget at a moment’s notice.

*Subject to transaction eligibility and credit status

14.8% APR

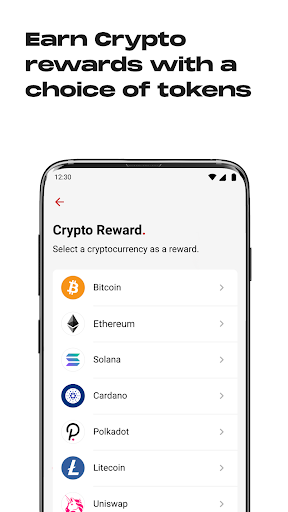

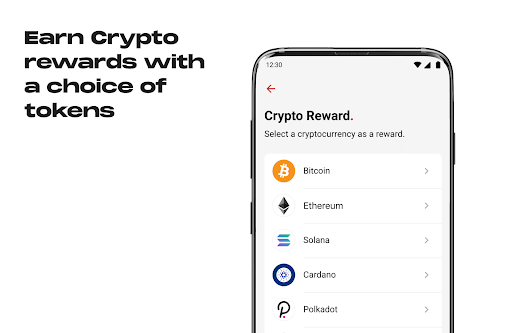

Maximise your rewards

Earn cashback on top of any rewards you get with another card. All your cashback builds up on your Curve Cash card, a built-in rewards card in your Curve Wallet.

Travel benefits

Escape fees on all your cards when you travel. Banks and credit cards can charge as much as 3% every time you spend abroad. Add the same cards to Curve to avoid foreign transaction fees no matter what card you use. And you can withdraw up to £200/month with no foreign ATM withdrawal fees.

Sharper insights

The power to see your spending history across all your cards at once. Curve gives you 20/20 vision with all your account balances and spending history in one place. Get categorised breakdowns of your spending and get live notifications every time you spend to stop fraud in its tracks.

Extra security

Protect your money with an extra level of security. When you add your cards to Curve, you can lock and unlock your Curve card instantly in the app. And if it’s lost or stolen, you only ever have to replace one card. Curve Customer protection is similar to the section 75 protection you get with a credit card – but applies to any card you’ve added to Curve. So all your purchases can be protected against fraud.

You need to be 18 years or older to sign up to Curve.

*Terms and privacy policy apply at www.curve.app. FX subject to caps and weekend charges. Cashback with selected retailers.

Show More

Screenshots

Comment

Similar Apps

Top Downloads

Copy [email protected]. All Rights Reserved

Google Play™ is a Trademark of Google Inc.

ApkYes is not affiliated with Google, Android OEMs or Android application developers in any way.