Avibra: Benefits for Everyone app

free Avibra: Benefits for Everyone app

download Avibra: Benefits for Everyone app

Avibra: Benefits for Everyone apk

free Avibra: Benefits for Everyone apk

download Avibra: Benefits for Everyone apk

Avibra: Benefits for Everyone

4.8

100K+

About This app

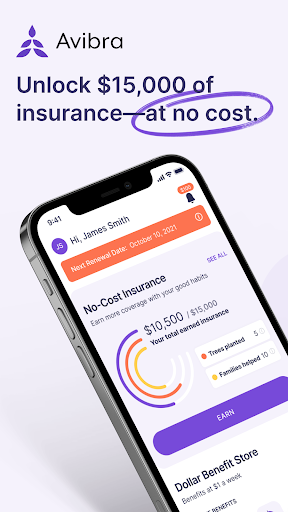

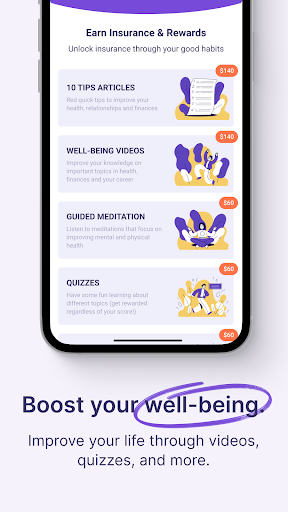

Avibra is the #1-rated insurance, finance, and well-being app that turns good habits and positive steps into insurance coverage. Each time you open our free app to read wellness tips, take a quiz, watch videos or listen to meditations, your insurance coverage grows—at no cost to you. Plus, you’ll improve your health, finances, career, relationships and community in the process.

Earn $15,000 of insurance by engaging with our app

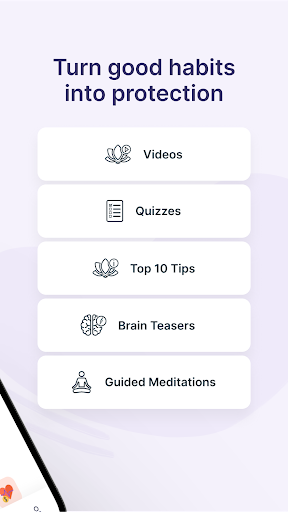

Get weekly notifications about new content you can use and apply in order to build your insurance coverage without spending a dime. This content includes:

Guided Meditations—boost your mental and physical health.

Quizzes—make learning fun while you improve your well-being.

Videos—get inspired, plus learn more about health, finances, and work.

Brain Workouts—strengthen your brain activity and improve memory.

Gratitude Journal—re-discover what you’re grateful for.

10 Tips—improve your health, relationships and finances.

Avibra Yoga Studio—bring calm, peace, and balance to your life.

Relaxation Music—ease everyday stress and anxiety.

Bonus: Also turn your daily activities from your wearables into rewards (think Fitbit, Apple Health, Google Fit).

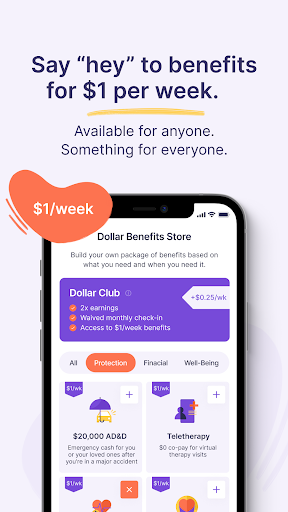

The Dollar Benefits Store

Welcome to our Dollar Benefits Store, where you can buy peace of mind for just $1/week. Purchase one benefit or several—just pay $1/week for each one you choose.

Accident Medical Benefits: Your accident medical benefit helps protect you from those high hospital bills following a covered accident such as a broken bone, concussion or burn.

Accidental Death & Dismemberment (AD&D) Benefits: Provides a benefit payment to you or your beneficiaries if you become disabled or die in a fatal accident.

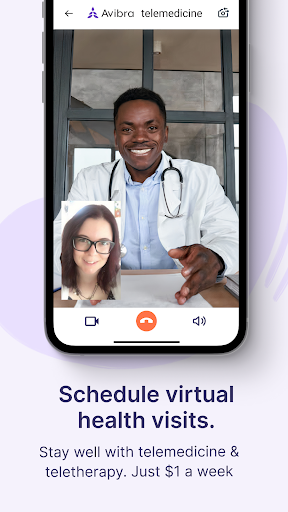

Telemedicine: Unlimited 24/7 virtual visits, 365 days a year. Telemedicine doctors can provide treatment and advice for allergies, sports injuries, skin inflammations and more.

Teletherapy: Online therapy available 7 days a week. Teletherapy counselors can provide treatment for conditions like depression, stress, eating disorders, addiction, relationship problems, anxiety, grief and more.

Life Insurance: Paid out in a single lump sum to your beneficiary upon your death, life insurance protects your loved ones when you’re gone. The money is commonly used for funeral costs, medical bills and day-to-day bills.

Cell Phone Protection: For damage (including water damage) and theft.

Risk Advisor: To monitor your risks in life, your Risk Advisor includes myRadar, myDwelling, myHealth and myRide. Each feature allows you to check for common everyday risks. The Risk Advisor uses information about your location, real-time driving habits and more to help you live smarter and safer.

Critical Illness: This benefit covers cancer, heart attack, stroke, and renal failure. The fixed lump-sum cash benefit can be used to help pay out-of-pocket medical expenses like deductibles and co-pays, or non-medical expenses like grocery delivery, childcare, and more.

Roadside Assistance: For towing, emergency tire changes, lockout, battery and fuel delivery service.

Our commitment to you

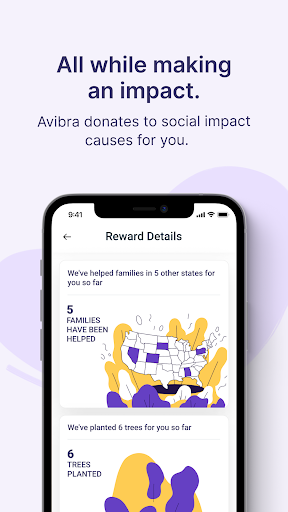

Avibra is a socially-driven company at its core, and we give back to the community on an ongoing basis. Avibra works with TIST to plant a tree each month for active users, donates regularly to important social causes, and helps you anonymously protect another family in a different state each week when you stay active in the app.

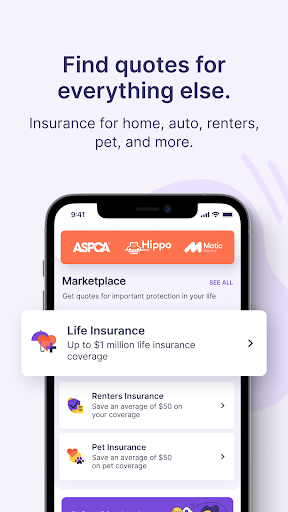

Plus, enjoy myShield for additional insurance options

Find other affordable insurance plans available for purchase in-app, including home insurance, auto insurance, renters insurance, and pet insurance.

We partner with reputable sources like Hippo Insurance, ASPCA, MSI and Matic.

Live A VIBRAnt life with Avibra and enjoy peace of mind you can afford.

Download the app now.

By downloading and using Avibra, you agree to our current Terms of Use (https://www.avibra.com/Avibra_TermsofService.pdf) and Privacy Policy (https://www.avibra.com/Avibra_PrivacyPolicy.pdf)

Show More

Screenshots

Comment

Similar Apps

Similar Apps

Top Downloads

Copy [email protected]. All Rights Reserved

Google Play™ is a Trademark of Google Inc.

ApkYes is not affiliated with Google, Android OEMs or Android application developers in any way.